Incometaxindiaefiling.gov.in link

Incometaxindiaefiling.gov.in link: The government rules change with time, and so it is very important to work accordingly. In the present, Aadhar card and PAN card are among the most commonly used documents used for personal verification, and the current rules stipulate that “PAN card should be linked to Aadhar card”. Since the rules are evolving the government has also switched to a brand new tax portal for income.

The deadline to connect PAN card to Aadhar card expires on June 30. The earlier time frame was march 31, however considering the current situation, the income tax department , they have extended the deadline to June 30. The best part is that you do not have to go to any location to link your PAN card to Aadhar because the new portal will makes it simple to do the procedure at the convenience of your at home.

How do I link my PAN card and Aadhar on the brand new portal for income tax?

The first step to link the PAN with Aadhar visits the site https://www.incometax.gov.in/iec/foportal/.

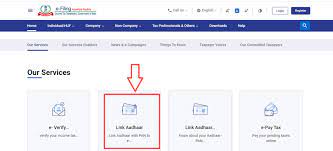

There’s a list of the services available on this website. On the homepage go until you reach”Our Services. “Our Services” option, there are many alternatives.

In the first place, click “Link Aadhar”, and it will take you to a different page where additional details will need required to fill in.

The new window will prompt you to input some crucial information such as PAN number Aadhar number and your mobile numbers. You must complete all the data that is you can on your cards.

Click on “I accept to verify my Aadhar information” to proceed further. In the event that your Aadhar card does not contain the year of your birth then a checkbox needs to be selected and click “Continue”.

After all steps have been completed after which you will be sent a 6-digit OTP within your mobile number that you have registered. Be sure that you input the OTP on the verification page when it is received, since the OTP is only valid up to 15 minutes.

Then, click “Validate” and it will open a pop-up that reads “the request to link your PAN with your Aadhar card has been accepted”.

FAQs

Why is it important to connect PAN to an Aadhar card?

It is now mandatory to connect PAN to Aadhar. Aadhar, and one who is not able to do so will be punished. It is also possible that the PAN card will be deemed unusable, and one has to pay a sum of 1,000 rupees as penalty. Additionally the cardholder will have to complete the procedure for renewal.

What documents are needed for linking PAN to Aadhar?

The applicant must be prepared to go through the process with their PAN, Aadhar card and also an active mobile number. The new portal makes it easy to complete the procedure without any hassle, and one can do it on their own from home.

Conclusion

Therefore, if you yourself are an are an individual or working as an entity that files the income tax return and have bank transactions exceeding Rs. 50,000, make sure you connect your PAN and Aadhar. Anyone who does not do this is not able to make the transaction or even file for the tax on income, and so it is best to finish the process prior to the 30th of June 2021.