The El Dorado Exchange operates as a decentralized cryptocurrency exchange that has been established on the Ethereum blockchain. This platform provides a secure and decentralized way for users to engage in the trading of different cryptocurrencies, such as Bitcoin, Ethereum, and other ERC-20 tokens.

The platform has been specifically developed to offer users a non-custodial trading experience, which enables them to maintain complete control over their funds throughout the trading process. To achieve this, trades are executed through the use of smart contracts, which ensure the transparency and security of all transactions.

El Dorado Exchange provides liquidity pools that enable users to stake their cryptocurrencies and earn rewards in the form of trading fees. By doing so, users are incentivized to contribute liquidity to the exchange, which can enhance the overall trading experience for all platform users.

What is EDE token(El Dorado Exchange)?

The El Dorado decentralized exchange (DEX) utilizes the EDE token (El Dorado Exchange) as its native utility token. This ERC-20 token is constructed on the Ethereum blockchain and functions as the primary medium for exchange and governance within the ecosystem of the El Dorado Exchange.

EDE serves various purposes within the El Dorado Exchange platform, given its status as a utility token. Among the primary use cases of EDE are the following:

- Trading Fees: When it comes to trading fees on the El Dorado Exchange platform, EDE can be employed as payment. Using EDE to pay for trading fees can lead to advantages and reduced fees for users.

- Governance: Holders of the EDE token can partake in the governance of the El Dorado Exchange platform. This involves the capacity to cast votes on proposals and decisions concerning the exchange’s development and operation.

- Staking Rewards: By staking their tokens, EDE token holders can provide support to the network and receive rewards. These incentives can take the form of extra EDE tokens and other benefits.

- Liquidity Provision: Users can offer liquidity to the El Dorado Exchange platform by utilizing EDE tokens. This can lead to rewards in the form of trading fees and other benefits.

What is the current price of EDE Token?

There is a maximum quantity of 30,300,000 EDE coins and no known circulating supply. The highest price paid for El Dorado Exchange(EDE) is $16.9, which was recorded on Feb 17, 2023. At the time of writing, EDE market cap is 2,569,871. The current EDE token price is $4.75 per coin. The 24-hour trading volume for the coin is $194,280.

How Does El Dorado Exchange Work?

Smart contracts are utilized by the platform to conduct trades and manage user funds. These contracts are self-executing and are programmed onto the Ethereum blockchain. They function as digital escrow accounts that hold the funds of both parties until the conditions of the agreement are fulfilled.

Upon placing an order on El Dorado Exchange, the platform initiates an automated search for a corresponding order on the opposite side of the market. Upon discovering a match, the smart contract proceeds to execute the trade by transferring funds from one user to the other.

Users can contribute to the liquidity of El Dorado Exchange by staking their cryptocurrencies in its liquidity pools. In doing so, they are incentivized to participate in the exchange, resulting in enhanced liquidity and an improved trading experience for all users.

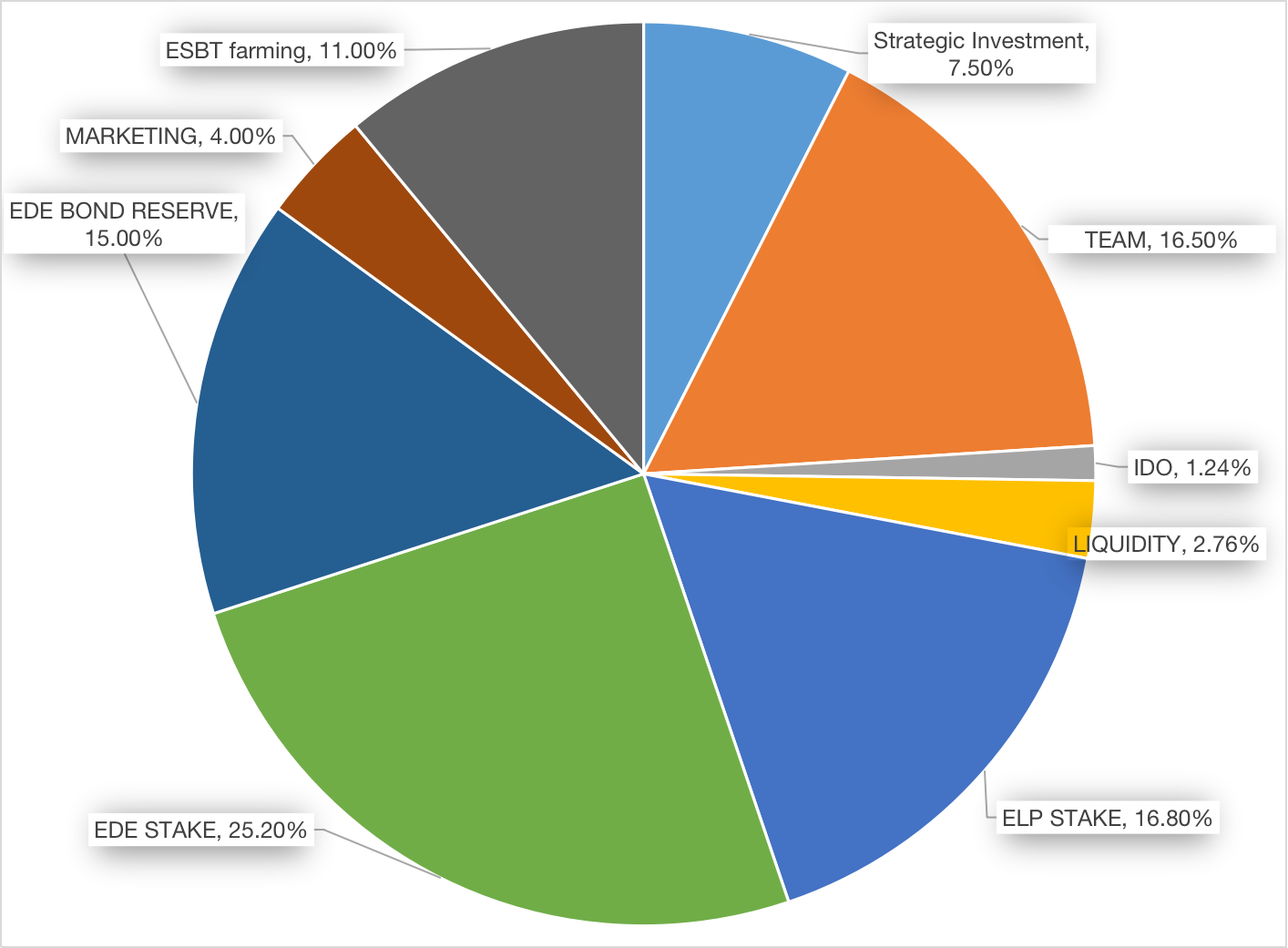

EDE Tokenomics

El Dorado Exchange seeks to offer a decentralized substitute for established cryptocurrency exchanges, with an emphasis on user control, security, and transparency.