Before we define contra entry, let me explain how we deal with it on a regular basis. Have you ever withdrawn money from an ATM? Have you visited your bank and deposited money into your account? Have you moved funds from one bank account to another?

What is Contra Entry?

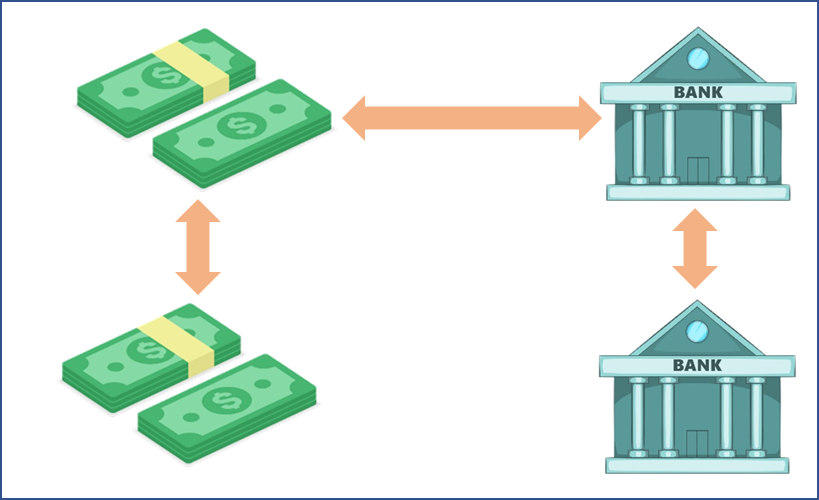

Cash and bank transactions are referred to as contra entry. Counter access is any input that impacts both cash and bank accounts. Contra means “opposite” in Latin. It is most commonly known as a counter voucher.

To simplify the terminology, any transactions involving the transportation of cash from one cash account to another, cash account to another bank account, or bank account to another are contra entries. For example, if a corporation withdraws money from its bank account to cover daily expenses, the following access is made: Cash accounts are debited, while bank accounts are credited.

It is vital to note that the above item does not affect the balance sheet because the cash flow between the two asset accounts is different.

Contra Entries can be made for the accounts listed below:

- Cash on hand Petty cash Cash at the bank

- Contra Account Types

- Contra accounts are contra asset, contra liability, contra equity, and contra revenue.

Asset in Opposition

The most popular type is a contra asset account. The contra asset accounts incorporate an allowance for doubtful accounts and the accumulated depreciation. Contra asset accounts are formed with a credit balance, which reduces the asset’s balance.

Liability vs. Liability

One of the most common types of contra obligations is the discount on notes or bonds due. The balance of contra obligations is negative. Counter liability accounts, unlike contra asset accounts, are not as standard as they once were.

A debit balance obligation can be utilized to reduce the amount of another liability. The balance of the contra account is equal to the amount owed to the report. Contra-responsibility reports are used less frequently than comprehensible counter-asset accounts. It is not classified as an accounting liability because it is not a future obligation.

Equity in Opposition

Contra equity is the third sort of counter. These contras reduce the equity account balance and leave a debit account balance. When a company uses contra equity, its overall balance sheet share decreases. Contra equity accounts are often treasury stock, which records the amount of money spent on stock purchases.

Contra Revenue Accounts that earn contra revenue can take advantage of sales discounts, allowances, and refunds. Gross income was reduced due to the contra revenue, resulting in net income. These counter-revenue accounts are more likely to be in the negative.

Contra entry examples

Some examples of the counter entrance are provided below. INR 2,500 in small cash moved cash is a counter entry because it affects accounts, money, and a small cash account. A counter entry is a cash obtained from a bank for office – INR 2 500 because the transaction affects both money and bank accounts. Because it covers two accounts, cash, and the bank account, the INR 12,000 bank account is a counter entry. This was in brief about the contra entry. To know more about the golden rules of accounting,visit us.