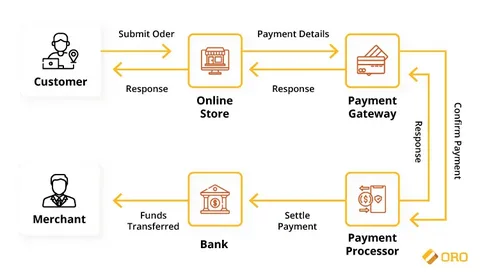

Payment Gateways facilitate money transfers between customers and merchants by enabling transactions to be transmitted securely to banks. Payment gateways are important because they help protect customer data. They encrypt it before it is sent out, and they make sure that it arrives at its destination safely. The gateway also ensures that the data gets sent to the processor in a timely manner. This helps to ensure that the customer’s transactions are processed quickly and without any problems. This protects customers from unauthorized access to their personal information. It is a software or hardware device that helps process payments for online retailers.

It provides a simplified checkout process, which can reduce the number of fraud attempts and make it easier for customers to make purchases. This is because it reduces the number of steps that need to be taken in order to make a purchase. Additionally, payment gateways help reduce the amount of time that is needed to process a payment. They also allow online stores to accept payments from different countries without having to install separate payment systems in each country. This makes it easier for the store to expand into new markets, and it also helps reduce the risk of fraud. If you’re a growing business striving to improve financially and legislate your customers’ cash activities, you’ll need to incorporate payment risk management that will prevent you from unauthorized activity while also maintaining your accounting information. Online payments make the payment task quicker for your buyers while also enhancing your sales revenue by documenting payments quickly.

What Is Payment Gateway?

A payment gateway is a software or online service that facilitates the process of money transactions. It allows businesses to accept payments from customers by connecting to their bank accounts. This way, the business can avoid having to build its own payment processing infrastructure. The payment gateway also helps to keep customer data safe and secure by encrypting it and storing it in a separately managed database. It also provides security features such as fraud protection and data encryption. It also allows you to manage your transactions from a single platform. It helps businesses to process payments quickly and easily. Merchants can use a payment gateway to accept payments from their customers using credit cards, debit cards, or PayPal. The payment gateway also offers merchant accounts that allow businesses to manage their finances and customize their online checkout experience.

How can you make your payment system more reliable?

If you start an online business, ensure your mode of payment is much more protected and encoded so that buyers can recognize you. Payment risk management can assist in the mitigation of electronic money theft. As the number of online shoppers rises, embracing payments online becomes exceedingly challenging. Using a Protected Online Payment solution can improve your company from fraudulent activity and cyberattacks. This will help protect your data by encrypting it and routing it through a secure server. The gateway will also verify the identity of the customer and the validity of the payment. This will help ensure that your customers are legitimate and that their payments are valid. It will also help you track the activity of each and every card transaction. Ultimately, this will help you keep your customers’ data safe and protect your business from fraud. By doing this, you can ensure that your customers’ credit card information is protected. A payment gateway will also help you track which pages are being visited on your website and track how much money is being spent. This will help you identify any problems with your payment system and make necessary changes. This system will help you to protect your customer-sensitive data and reduce the chances of fraud. By using this technology, you will be able to safeguard your business against cyberattacks. Additionally, this system will make it easier for your customers to pay for goods and services.