There has been a lot of discussion about liquidity and volatility in the Forex market, but what exactly do they represent? This article will give all the answers. Below we will take a closer look at what forex market liquidity is and how it influences trading in one of the most competitive markets in the world. Besides that, we will tell you how to maintain a competitive advantage when investing in a forex market with a large number of traders. When you trade, if you know what you want, you can make better decisions and improve your chances of being successful.

What Is Forex Liquidity?

Liquidity describes how easy it is to buy or sell an asset on the financial markets. If an asset can be quickly and easily turned into cash without losing any value, it is considered as liquid.

On the FX market, a currency’s liquidity is how easy it is to buy or sell on the market without changing the price. With a daily trading volume of more than $5 trillion, the forex market has become the most liquid global financial market. That said, there is always some activity on the market. Thus, it is easy to reach a buyer or seller for any currency pair trader wishes.

When there are a lot of money transfers every day on the Forex, it is said to be “highly liquid.” This implies there are more buyers and sellers on the market, making it way more easier for traders to make moves instantly and at a fair cost. On the other hand, a market with illiquid assets may have trouble finding buyers or sellers who are ready to trade at the current market prices. This makes it considerably more complicated to make trades.

Therefore, markets with a lot of liquidity give traders more chances to make money, while markets with less liquidity may be harder to trade in. But you can make money in either market category if you understand what to search for.

It’s essential to look at the bid-ask spread when dealing in a market with a lot of activity. This is the difference between how much people are willing to pay and how much people are willing to sell for. You can use the bid-ask spread to figure out how liquid a market is. When a market is very liquid, the spread will be small. When a market is less liquid, the spread will be much larger.

When trading in a market that is particularly liquid, the quantity of volume is another vital thing to think about. This is how many transactions happen in a specific time frame. When a market is very liquid, there will be more volume, which means that there are more trades. This can make it easier to find trades that fit your strategy.

When trading in a market with less activity, it’s important to know how busy the market is. This is how many traders are actively buying and selling on the market. If there aren’t as many traders in a market, it may be tricky to acquire trades that fit your approach.

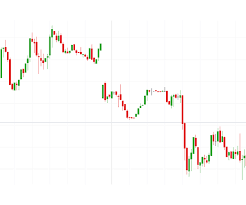

Watching the price action is another aspect to keep constantly in mind. This is how prices change over time. When there is a lot of money in the market, prices increase quickly and with ease. Price levels may fluctuate more slowly and inconsistently in a market with less supply and demand.

Therefore, bear in mind that while being a part of Forex, liquidity is one of the most important things to think about. A market with a lot of buyers and sellers gives you more chances to accept money, while a market with fewer buyers and sellers might be more challenging to trade in. But you can make money in either type of market if you know your goals.

What Creates Liquidity?

There are many things that affect how liquid a market is.

Capital flows

Forex market liquidity can be affected by a softening of monetary policy. When central banks cut interest rates or add cash to the amount of money in circulation, the market becomes more liquid. Traders can buy and sell assets more easily without changing the price. This can also make the market more active and give people more chances to make money.

Flows of capital

Capital flows are another thing that affects how liquid a market is. When a lot of money comes into or goes out of a market, it can change the price of assets. Based on the direction of the flow, it can make a significant difference for traders who are buying or selling assets

Market sentiment

Liquidity can also be affected by how the market feels. When traders are optimistic, they are more likely to buy assets and take risks. This can lead to more people undertaking trades which boost prices to go up. When traders are bearish, the overall trend is to sell and keep the profits.

Intervening from the government

Market liquidity is also affected by what the government does. When governments buy or sell assets, it can change the price and make it more challenging or easier for market participants to buy or sell.

Those are just a few things that can affect how well the market works. When trading Forex, it’s essential to keep an eye on all of these things.

What Liquidity Providers Do

As we are moving toward a digital economy, the role of LPs has never been more relevant. With the rise of blockchain and crypto, new financial institutions are entering the market and making it more liquid. Exchanges, trading platforms, and investment firms are all examples of such institutions.

Liquidity providers are very important to keeping the markets stable because they make sure there is enough buying and selling available. Without FX liquidity providers, prices would change quickly, and the markets would be much less stable. This is because when costs begin to shift in either path, nobody would be able to buy or sell.

Moreover, due to the rise of high-frequency trading (HFT), the contribution of liquidity providers has come under scrutiny in the past few years. HFT is a form of trading that uses an algorithm to put transactions at very high rates of speed. This can create issues for liquidity providers because they may not be able to keep up with the pace of the market. Also, HFT can lead to manipulating the market and other illegal measures.

Despite these drawbacks, liquidity providers remain an important component of the forex market. They keep things stable and make sure that there is sufficient buying and selling going on. This helps to establish a strong economy where valuations can start moving smoothly and systematically. The fact that all brokers work hard to find the best liquidity provider to satisfy their clients’ needs shows how important they are.

Bottom Line

Forex is the most liquid out of all the financial markets. When a market seems to be very liquid, there are more chances to make money. When a market is illiquid, it will be way more harder to trade in. However, if you understand what to search for in a market, you can make money in any kind of market with proper planning and strong discipline.